Lock up your WBTC, ETH and USDC to mint PAR tokens and earn high yielding APYs through Liquidity Mining Pools.

Dubai, 26th March 2021, ZEXPRWIRE – As cryptocurrency developers, programmers and enthusiasts, our team has always been at the forefront of the most innovative solutions and services for the crypto sphere.

One of our projects launched in 2017, TenX, served as a wallet platform developed and associated with the use of a debit card in alliance with the Visa network. It was successfully used by many crypto users who found a solution for spending their cryptocurrency through a Visa debit card accepted in most countries of the world.

Our team has always wondered how to help cryptocurrency users to make the most out of their digital assets easily. We decided to ask ourselves how people could use their assets using a platform built on blockchain technology while keeping it simple and easy. We have listened to our users and realized that spending digital assets should not end their crypto journey because it means users lose their desired ongoing exposure.

Today, with the growth of decentralized finance (DeFi) protocols and platforms developed through smart contracts, the advancement of technology, and the industry’s maturation, our team decided to continue advancing and developing a new, more robust product. This is how Mimo DeFi was born. Mimo DeFi is the first DeFi “lending” platform that allows to mint a stable token algorithmically pegged to the Euro (the Parallel token, or PAR) by locking up (rather than spending) digital assets such as ETH and WBTC. This makes the PAR the first fully decentralized stable token of its kind.

Mimo DeFi is the first platform that allows users to mint EUR-pegged tokens without spending their digital assets. Provided that they lock up digital assets of sufficient value, users retain ultimate control of their digital assets, meaning they can continue to benefit from their price appreciation in the market while at the same time minting PAR tokens, which can be used in the DeFi marketplace.

Besides, Mimo DeFi offers a very attractive market rate for this arrangement, currently only 2%, with the possibility of continuing to generate income if the user decides to place their PAR tokens in liquidity pools that will generate additional returns for the holder.

Mimo has been audited by Quantstamp, and passed the audit with flying colors. This helps to show that the Mimo DeFi Protocol works as intended on the Ethereum platform, keeping users’ balances safe. By being audited by other companies in the crypto sphere, we hope to increase our users’ confidence in, and the overall transparency of, the project. Mimo will publish the results of new audits soon.

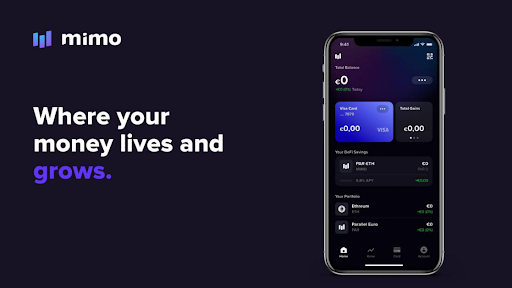

We recently launched a revamped Web App and Wallet with a straightforward and simple UX & UI as part of our constant development and improvement. The revamped version of the Protocol added more types of cryptocurrencies to be used in a similar way as described above, making it simple to lock up digital assets for minting PAR tokens.

Mimo DeFi is set to evolve into a community governance model where MIMO token holders will participate through on-chain voting on different operations and upgrades to the Mimo protocol. This ensures proper distribution of power among token holders for certain decisions to be taken on the platform, guarantees its decentralization, and increases the community’s involvement in the platform’s tokenomics.

For more information regarding Mimo and the PAR token, visit Mimo Capital

Please follow our groups & more information on Company:

Website: Click Here

Telegram Group: Click Here

Twitter: Click Here

Facebook: Click here

The post Mimo DeFi Protocol: The World’s First Decentralized Euro Stablecoin appeared first on Zex PR Wire.

Information contained on this page is provided by an independent third-party content provider. Binary News Network and this Site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact [email protected]